This multi-part blog is all about Lifetime value and how to use it – both to measure and optimise PPC campaign performance.

The aim of this blog series is to explain the significant benefits of using Lifetime value for optimising PPC campaigns. By comparing lifetime value to other metrics commonly used for optimisation, the potential impact on profit is explained with examples.

In part 1, we will be looking at what Lifetime value is. There is some guidance on how to calculate it and also how to use Lifetime value to measure PPC and other marketing performance.

When it comes to measuring the results of PPC campaigns there are a wide range of common practices.

PPC performance is often typically measured on everything from impressions, clicks and quality score through to sessions, behaviour onsite and conversions. However, I believe the only true measure of a PPC campaign is profit – put simply:

PPC Profit = Net Profit from sales – advertising costs.

If the PPC profit isn’t increasing, relative to external factors (seasonality, market growth, etc.), then the account isn’t being optimised effectively. Increase your quality score to 10 all you like, but if you’re not increasing profit then something is going wrong.

The trick is to know exactly what the net profit is and this is where lifetime value comes in.

Lifetime value is simply the value you expect from a customer over their life as a customer with you.

This is all the future revenue expected from each customer – including any recurring revenue, additional purchases, up-sells, customer referrals and any other revenue generated.

For those new to lifetime value, this may seem an impossible question to answer. It is impossible to calculate exactly in most cases. However, the key to calculating lifetime value is to get as close as you can and to be conservative with your estimate.

The full answer to this question is beyond the scope of this article.

Here is an example of a very simple calculation:

LTV = Annual Profit Of Customer X Number of Years Customer Remains

The calculation you use should be based on your business but ultimately there will be some common themes to look out for.

It is important to include all costs related to each source of revenue from each customer. How much profit are you making from each transaction?

How long the lifetime of a customer is in years or months is up to you. Two or three years is common, but it could easily be longer or shorter.

However you end up calculating your Lifetime value, you should do it in a way that makes you feel very confident that your Lifetime value is accurate and conservative.

For example, if you have calculated your Lifetime value per customer is £250, then you should feel confident that acquiring customers for a cost of £249 each is profitable – but not that profitable!

The key with LTV is to get as close to the real figure as possible – it is not a cost per acquisition target built with a healthy margin. It is a description of the value of each of your customers.

You know that all of your customers do not make you the same amount of money. The key is to identify which customers make you the most money.

This could be as simple the first payment they make to you, or the first product they purchase from you. Does a certain product or service attract more repeat business? Is there a certain customer profile that is more or less profitable than others?

One good way to identify different lifetime values is can be through the source of the customer – how they came to you in the first place.

In PPC, keywords that the customer uses could give you an indication of the type of customer they are likely to become. This type of hypothesis can be tested in PPC to determine if certain keyword themes lead to higher value customers.

You can also compare PPC to other sources of traffic to determine different LTVs per source.

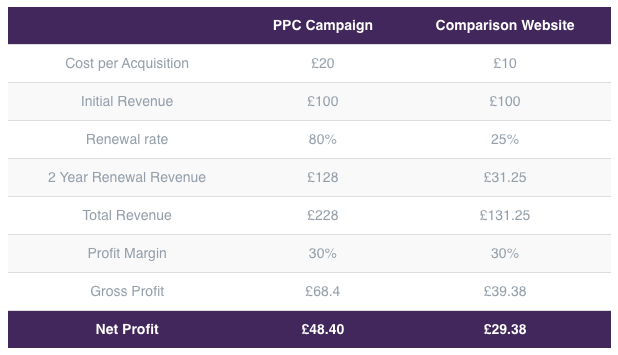

Here is an example of how this might look for an company buying conversions from a comparison site and also running PPC campaigns:

In this example, the customers from a comparison website have a lower renewal rate than those from the PPC campaigns. Those customers who use comparison websites are less likely to renew – they use comparison sites to find the best deal when it comes to renewing. Those customers coming via PPC are less likely to use comparison websites and are more likely to renew.

This example highlights the potential pitfalls of using cost per acquisition as the key metric for analysing all marketing and PPC performance.

The PPC campaign cost per acquisition is twice that of the comparison website, but the profit is also 65% higher.

However, using cost per acquisition to optimise PPC campaigns can have far larger implications on total PPC profit.

We’ll talk about that next week in part 2.

ABOUT THE AUTHOR

Wayland Coles is MD and Founder performance marketing agency Atomic Leap, where he helps businesses of all sizes capitalize on the power of PPC marketing.

LinkedIn: Wayland Cole